Portfolio diversification is a key element to achieving FIRE, they Exchange Traded Fund (ETF) they are a versatile tool for diversifying your investments efficiently and at low cost.

I due Ultimate ETF to invest in when it comes to building a portfolio for FIRE they are the ETF MSCI World and l‘S&P 500.

SP500 and MSCI World Compared

S&P 500 eMSCI World are two important market indices that attract the attention of investors. Let's see the differences between the two:

S&P 500

S&P500 stands for Standard & Poor’s 500. It is the most important stock index in the United States, created by Standard & Poor’s nel 1957.

The index follows the market trend of 500 US companies with the largest capitalization.

The shares of these large companies are traded on the New York Stock Exchange (NYSE), all’American Stock Exchange (AMEX) e al Nasdaq.

Here are some examples of companies that are part of the Standard index & Poor’s 500:

- Microsoft Corporation

- Apple Inc.

- NVIDIA Corporation

- Alphabet Inc. (both class A and class C shares)

- Amazon.com, Inc.

- Meta Platforms, Inc. (formerly known as Facebook)

- Berkshire Hathaway Inc.

- Tesla, Inc.

- JP Morgan Chase & Co.

- Visa Inc.

Historically, l’S&P500 hadsignificantly better returns compared to the MSCI World global index.

It is often used as a reference in financial literature.

MSCI World

The MSCI World is a stock market index consisting of thousands of global titles.

It is backed by MSCI, ex Morgan Stanley Capital International, and is used as a measuring stick (benchmark) for “world” equity funds (world) the “global” (global).

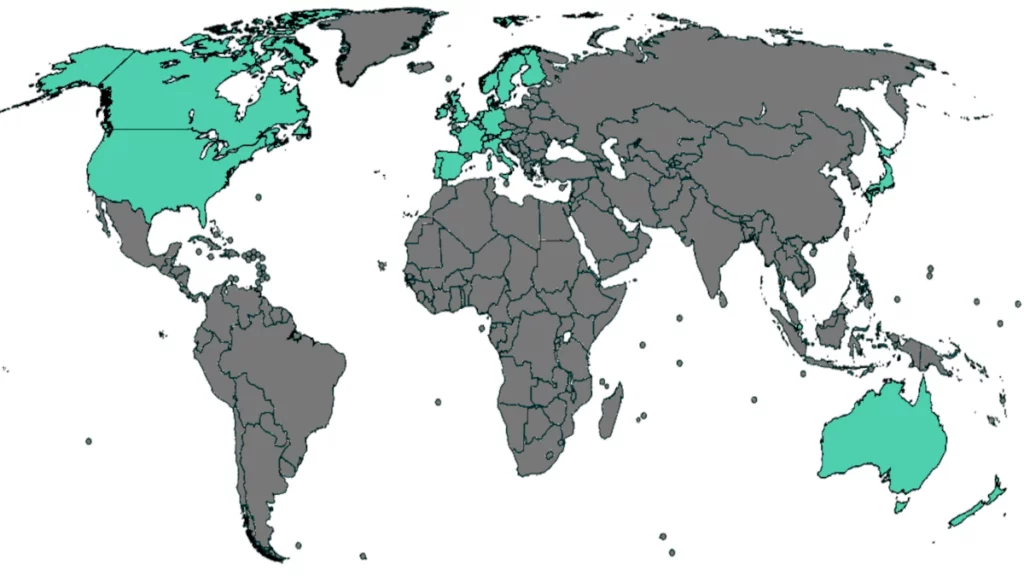

MSCI World tracks the stocks of23 developed countries around the world, excluding securities from frontier or emerging economies.

The majority of stocks within MSCI World are US-based, which explains thehigh correlation between the two indices.

Said this, the MSCI World index offers agreater geographic diversification compared to S&P 500.

Here are some other examples of companies that are part of the MSCI World index but not the S index&P 500:

- Novartis AG (Swiss)

- HSBC Holdings plc (United Kingdom)

- Unilever NV (Netherlands)

- SAP SE (Germania)

- Siemens AG (Germania)

- TotalEnergies SE (France)

- AstraZeneca PLC (United Kingdom)

- BHP Group (Australia)

- Sanofi (France)

- LVMH Moët Hennessy Louis Vuitton (France)

The Italian companies that are part of the MSCI World I am:

- Enel SpA

- Eni SpA

- Intesa Sanpaolo SpA

- UniCredit S.p.A

- Generali Group

- Poste Italiane SpA

- STMicroelectronics NV

- Telecom Italia SpA

- Prysmian SpA

- Saipem SpA

MSCI World o S&P 500: Which is Best to Invest In?

Both indices are moderately diversified and they have a relatively low risk, which makes them ideal as a long-term investment for those who want to have exposure to the shareholder market and as an integral part of a FIRE portfolio.

The choice between one or the other comes down to these differences:

Number of shares

- MSCI World includes stocks of 1.480 medium and large capitalization companies.

- The main sectors within the MSCI World Index are the IT sector (23,67%), the financial sector (15,21%) and the health sector (12,29%).

- L’S&P 500, as the name suggests, includes only the 500 largest companies in the United States, like Facebook, Amazon, Apple, Johnson & Johnson and many others.

- The main sectors within the S index&P 500 they are the IT sector (20,7%), the health sector (15,0%) and the financial sector (13,6%). The composition of the index varies over time due to market fluctuations and the performance of individual companies.

Geographic diversification

- MSCI World offers greater geographic diversification, because it doesn't just track shares of US companies. US stocks represent those with the highest weighting within the MSCI World index with a weight of 70,14%, followed by Japan (6,24%) and from the United Kingdom (3,92%).

- S&P 500 is exclusively focused on the US stock market, so it has a slightly higher risk.

Performance

- The index MSCI World tends to have a lower yield, but is more risk averse. In the last decades, the MSCI World provided an average annual return of approximately 8,70%.

- L’S&P 500 historically tends to perform better. In the last decades, l’S&P 500 provided an average annual return of approx 10,70%.

- Historically, the performance of the MSCI World was closely correlated with that of the S&P 500 over a period of 10 years, although there may be short-term differences.

In other words, the choice between MSCI World and S&P 500 depends on geographical and sectoral diversification preferences, as well as the level of risk and expected return.

If you want more geographic diversification and slightly lower risk, MSCI World might be your best bet.

However, if you prefer greater exposure to the US stock market and a potentially higher return, l’S&P 500 it might be the most appropriate choice.

Read also: Best Stocks to Invest in Long Term

The information in this article is provided for informational and educational purposes only. They do not constitute in any way a solicitation for investment, a recommendation or personalized advice to buy, sell or hold the shares mentioned.

Historical performance data and reported dividend yields are not indicative of future results and do not guarantee similar returns. The value of investments and any income from them may fluctuate and there is no guarantee that you will get back the amount originally invested.

The opinions expressed on the long-term attractiveness of these securities represent the subjective opinion of the author based on available information. They should not be interpreted as a certain prediction of future share price movements.

It is recommended that you consult a qualified financial advisor before making any investment decisions. The author and the website assume no responsibility for any loss or damage arising from the use of the information in this article.

The Italian community of the FIRE movement (Financial Independence, Retire Early) to stop working and retire young.